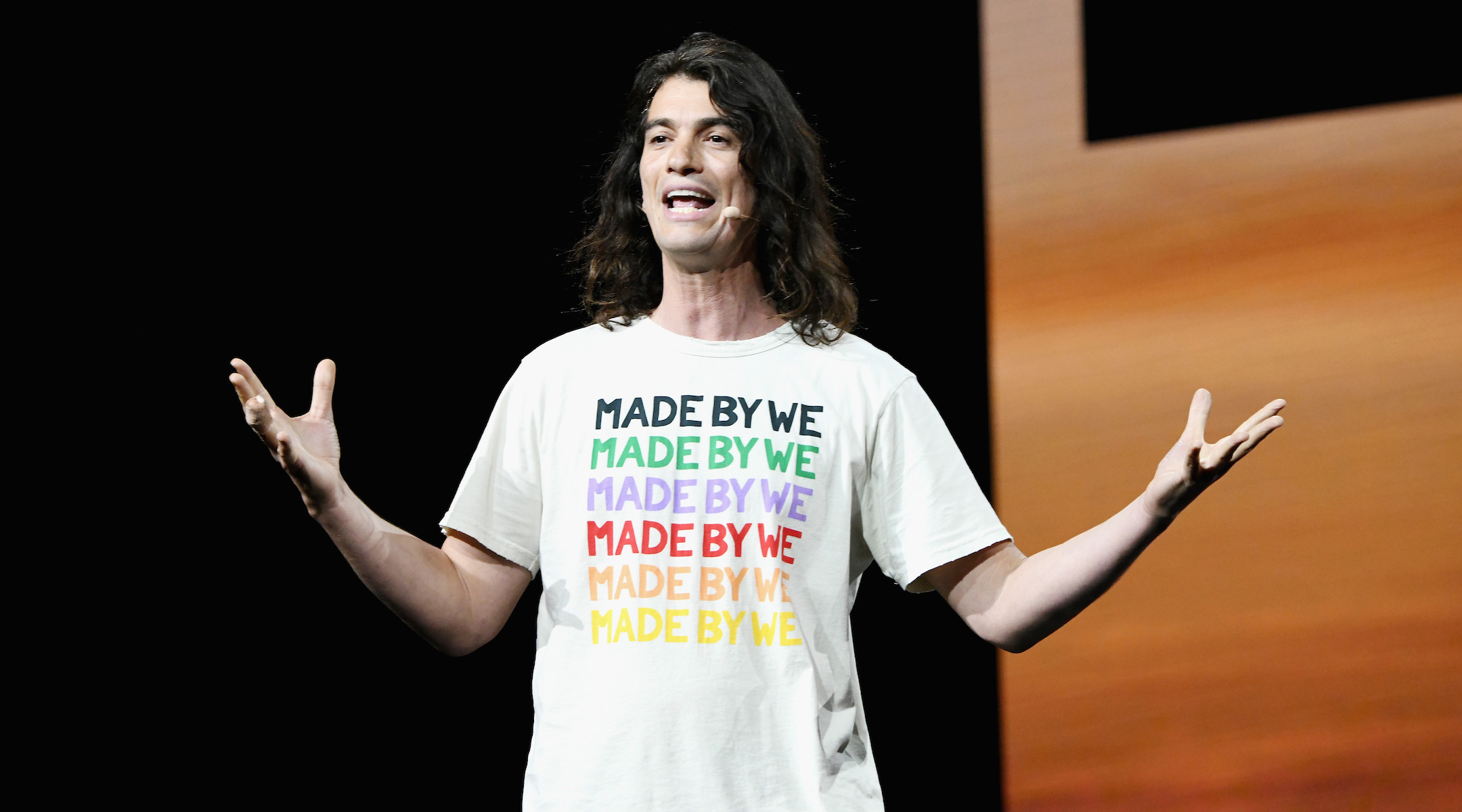

(JTA) — WeWork co-founder Adam Neumann will get a $1.7 billion buyout as part of a takeover deal to rescue the company.

The SoftBank Group Corp., a Japanese conglomerate and WeWork’s largest shareholder, will put $13 billion into a company that is valued at $8 billion.

Neumann, 40, was forced out as chief executive last month but has remained chairman of the WeWork parent firm, We Co. Under the bailout, the Israel native will step down from the board but remain an observer and hold a minority stake, The Wall Street Journal reported.

The deal will give SoftBank 80 percent ownership of the company, which at the beginning of the year was valued at $47 billion and heading for an initial public offering. The IPO has been delayed, however as the company suffered a major devaluation amid investors’ fears over the charismatic but unpredictable Neumann’s control of the firm.

According to the report, Neumann has promised to work exclusively with the company for four years. In addition, SoftBank will extend Neumann credit to help him repay a $500 million loan program led by JPMorgan and pay him a $185 million consulting fee.

Neumann, who grew up on a kibbutz, has been reported to have left a stuffed box of marijuana on a private plane he flew to Israel for the trip back; banned company employees from eating meat, then allegedly was caught eating meat afterward; and threw a lavish party (featuring a member of Run-DMC) just minutes after firing 7 percent of the company’s staff.

JTA has documented Jewish history in real-time for over a century. Keep our journalism strong by joining us in supporting independent, award-winning reporting.